Token payment 3D Secure: Difference between revisions

| Line 690: | Line 690: | ||

== Testing the whole payment flow, without challenge == | == Testing the whole payment flow, without challenge == | ||

Use the OTP test cards, they will always get a "frictionless" flow, where the 3DS process is presented on the UI, but you will never see a challenge screen. | Use the OTP test cards (to-be-defined), they will always get a "frictionless" flow, where the 3DS process is presented on the UI, but you will never see a challenge screen. | ||

This is good for testing your integration itself because it will lead to a successful charge, and you will get a TraceId as well. | This is good for testing your integration itself because it will lead to a successful charge, and you will get a TraceId as well. | ||

== Testing the challenge itself == | == Testing the challenge itself == | ||

Revision as of 15:08, 26 November 2020

Token Payment with 3D Secure

This payment scenario allows the integrator shop to register a token for a customer (and a funding source) in the Barion system and then, later on, using this token, charge the customer without redirecting her to the Barion Smart Gateway UI. The user may be present at the site of the merchant or she can be off-session as well, so the merchant can charge her e.g. for subscriptions. This means that the customer authorizes the shop to charge her card or Barion balance without typing in the card information or Barion login again.

Token payment scenarios

Token payment can be used in three use cases:

- Customer Initiated Payments: when the user is present on the website of the merchant and she decides to pay :

- OneClick payment: the user is charged upon her request initiated on the website of the merchant. Subsequent payments are subject to PSD2 SCA and as the user is present, she has to go through the authentication process.

- Merchant Initiated Payments: when the merchant initiates the payment without the user being present. It has two subtypes:

- Recurring payment: the user is charged with the same amount on a regular basis, typically in case of subscriptions. Subsequent payments are exempted from PSD2 SCA, but liability still shifts to the card issuer.

- MIT (merchant initiated transaction): the user is charged on an irregular basis and/or with a different amount. Subsequent payments of this type are excluded from PSD2 SCA, the liability is on the merchant.

Customer participation

Since the token scenario is suitable for both customer and merchant initiated payments here is a comparison about who starts the payment. This includes the regular, non-tokenized payment scenario as well:

| Scenario | Initial payment | Subsequent payments | ||

|---|---|---|---|---|

| Customer present | Customer at Barion Smart GW | Customer present | Customer at Barion Smart GW | |

| Non token (regular) payment | YES | YES | YES | YES |

| OneClick payment | YES | YES/NO1 | YES | NO |

| Recurring payment | YES | YES/NO1 | NO | NO |

| MIT | YES | YES/NO1 | NO | NO |

1 Token payment scenarios can be initiated with already registered RecurrenceId as well, in this case the customer may remain on the merchant's site.

Requirements for the scenarios

These token payment scenarios have different requirements, this table below summarizes the key differences.

| Scenario | Payment amount | Payment frequency | Liability in case of fraud |

|---|---|---|---|

| OneClick payment | Various | Various | Card issuer |

| Recurring payment | Subsequent amounts must be equal or less than the initial amount | Initial payment must define a minimum amount of days to wait between charges | Card issuer |

| Merchant initiated payment | Various | Various | Merchant |

3DS authentication of the payer

The new more secure 3DS v2 authentication must be performed for every online card payment. These token payment scenarios also have to use this new secure way of authentication. The initial payment of a token scenario must be authenticated every time although the subsequent payments may be exempted in certain cases.

Here is a table to compare the 3DS authentication requirements:

| Scenario | Initial payment | Subsequent payments |

|---|---|---|

| One-click payment | ✔️ | ✔️ |

| Recurring payment | ✔️ | |

| Merchant initiated payment | ✔️ |

Real life examples

Phone bill

Payer has a usage-based phone subscription that wants to pay without being present for every charge. She authorizes the phone company to charge her card every month.

- Scenario: Merchant Initiated Transaction

- Explanation: Despite the frequency of the charges is monthly, the amount of the subsequent payments may exceed the initial payment.

TV subscription

Payer subscribes to online streaming of a television channel. She authorizes the phone company to charge her card every month. The subscription fee is the same for every month.

- Scenario: Recurring payment

- Explanation: The amount of the subsequent payments will not exceed the initial payment and the charge is regularly monthly-based.

Bookclub with "free first month" bonus

Payer subscribes to a book renting service. She authorizes the book club to charge her card every month for a selection of books. The subscription fee is the same for every month however, the first month is free. To ensure the subscription the service requires her to register her card details.

- Scenario: Merchant Initiated Transaction

- Explanation: Despite the frequency of the charges is monthly, and the fee will stay the same, the initial payment is zero. So the amount of the next payment will exceed the initial payment.

Online food delivery service

The food delivery company wants to provide a quick and easy experience for its customer. They decide that the order will be quicker if the customers don't leave the website to pay for the goods.

- Scenario: OneClick payment

- Explanation: The customer will always be there so the other two scenarios are not available.

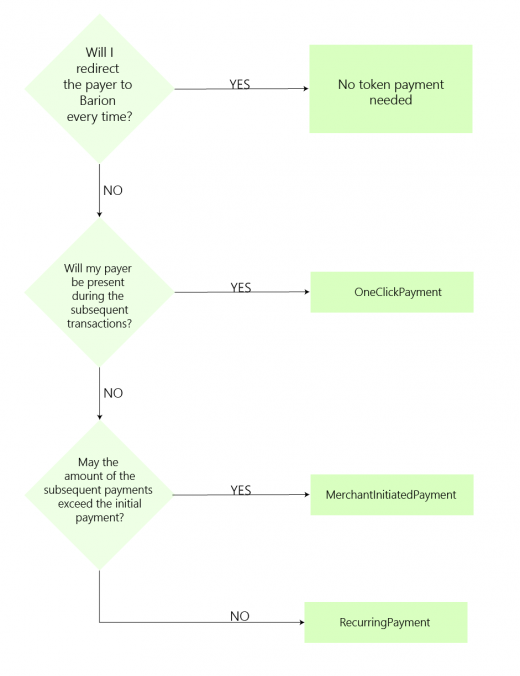

How to decide

To help you decide on a suitable scenario, please use the decision graph below:

Prerequisites

To be able to integrate your webshop with the Barion Payment Gateway:

- You must register a Barion wallet at the Barion website or in the Sandbox environment. Learn more about the Sandbox environment here.

- For this wallet you have to create a shop which should be approved by Barion.

- For every currency you plan to conduct payments in you have to make sure there is an account created in your Barion wallet. This means that if you plan to have USD payments then there should be a USD account created in your wallet.

- To make sure every corner case scenario works for your webshop it is best to top up that account with a small amount (approx. 5-10EUR or your choice of currency around the same value).

- For the technical communication guide please read this: Calling the API

The payment process

The process is divided into two major steps:

- Creating the token that represents one of the customer's funding sources (credit card or e-money wallet)

- Preparing the payment via the Barion API

- Redirecting the customer to the Barion Smart Gateway to select a funding source

- Processing the callback and requesting information about the result of the payment

- Using the registered token to charge the customer

Step 1: Creating the funding source token

To be able to use a token payment scenario first the merchant has to register the token with Barion. The merchant has to make sure that the customer is well aware of the fact that they are giving consent to a tokenized payment. The Barion Smart Gateway UI does not indicate in any way that the payment is a token payment.

The token is registered to the shop and not to the merchant's Barion account. So if the merchant has multiple shops in its Barion account, the registered tokens can not be shared among them even if the customer is the same. If you want to use tokens in multiple shops, please contact Barion in the Customer center.

1.1 Preparing the payment

The token registration is basically a normal payment with three extra properties in the Payment/Start request:

- InitiateRecurrence

- RecurrenceId

- RecurrenceType

InitiateRecurrence

The InitiateRecurrence property is a bool property. If you set it to true then the payment gateway will consider the payment as a token registration.

This happens even if the customer is already has a registered token, so you are able to re-register a funding source or even a customer.

RecurrenceId

The next required property for a token registration is the token itself. This is generated by the shop and has to be unique for every registration. The token should be specified in the RecurrenceId property of the Payment/Start request. This token must be saved in the webshops database. A RecurrenceId token represents the funding source (bank card or Barion balance) of a customer. Since a customer can have multiple cards and accounts as a funding source make sure that in the webshop's system multiple tokens can belong to a single customer.

RecurrenceType

The third required property is the Recurrence Type. This specifies the scenario. In case of Recurring Payment PurchaseInformation.RecurringExpiry and PurchaseInformation.RecurringFrequency must also be set.

Example JSON request for a Merchant Initiated Payment scenario

{

"POSKey": "[[SECRET_POS_KEY]]",

"PaymentType": "Immediate",

"PaymentRequestId": "EXMPLSHOP-PM-001",

"InitiateRecurrence": true,

"RecurrenceId": "SHOP-XMLP-TOKEN-ABC-123",

"RecurrenceType": "MerchantInitiatedPayment",

"FundingSources": ["All"],

"GuestCheckOut" : true,

"Currency": "EUR",

"Transactions": [

{

"POSTransactionId": "EXMPLSHOP-PM-001/TR001",

"Payee": "[[MERCHANTS_BARION_EMAIL]]",

"Total": 25.2,

"Comment": "Subscription fee for the first month",

"Items": [

{

"Name": "Website subscription",

"Description": "Website subscription for one month",

"Quantity": 1,

"Unit": "month",

"UnitPrice": 25.2,

"ItemTotal": 25.2,

"SKU": "EXMPLSHOP/SKU/PHC-01"

}

]

}

]

}The response will be the same as to a basic Immediate scenario. The RecurrenceResult property at this point is None since the token is not registered to a funding source yet.

Example JSON request for a Recurring Payment scenario

The Recurring Payment scenario has some extra restrictions. The merchant has to specify two additional properties in the Payment/Start request:

RecurringExpiry: The date after the subsequent charges should not accepted.RecurringFrequency: The minimum days the merchant has to wait between payments.

Both properties are located in the PurchaseInformation property and must be specified if this scenario is selected.

{

"POSKey": "[[SECRET_POS_KEY]]",

"PaymentType": "Immediate",

"PaymentRequestId": "EXMPLSHOP-PM-001",

"InitiateRecurrence": true,

"RecurrenceId": "SHOP-XMLP-TOKEN-ABC-123",

"RecurrenceType": "RecurringPayment",

"FundingSources": ["All"],

"GuestCheckOut" : true,

"Currency": "EUR",

"Transactions": [

{

"POSTransactionId": "EXMPLSHOP-PM-001/TR001",

"Payee": "[[MERCHANTS_BARION_EMAIL]]",

"Total": 25.2,

"Comment": "Subscription fee for the first month",

"Items": [

{

"Name": "Website subscription",

"Description": "Website subscription for one month",

"Quantity": 1,

"Unit": "month",

"UnitPrice": 25.2,

"ItemTotal": 25.2,

"SKU": "EXMPLSHOP/SKU/PHC-01"

}

]

}

],

"PurchaseInformation":{

"RecurringFrequency": 10,

"RecurringExpiry": "2022-10-01"

}

}Possible error responses

| Error code | Description |

|---|---|

| RecurringPaymentNotAllowed | The token payment is not allowed for the shop identified by the POSKey. Contact Barion to request this feature. |

1.2 Redirecting the customer to the Barion Smart Gateway to select a funding source

After a successful payment preparation, the customer is redirected to the secure Barion Smart Gateway to choose a funding source. The funding source the customer selects will be registered to the token. The funding source can either be a Barion e-money balance or a bank card. This means that even though the customer may own multiple cards only the one that was registered to the token can be used for future token payments. To change the funding source attached to the token a new registration should be requested.

1.3 Processing the callback and requesting information about the result of the payment

When the payment is completed (either successfully or unsuccessfully) a callback message is sent to the merchant's system. Once received a GetPaymentState request must be sent to the Barion API. On how to implement this please read the article about the Callback mechanism.

The full response of the GetPaymentState request depends on the payment scenario and the structure of the payment. When it comes to token payment there are several properties to look out for.

- In case the

Statusis Succeeded the funding source token is registered and ready to use. - The

TraceIdcontains the ID of the token process. This specifies the nature of the token payment.

TraceId

In case of Recurring payment or Merchant initiated payment scenarios the GetPaymentState response returns an additional field called TraceId. The value of this property is generated by the card issuer. The merchant has to save it and submit it in all subsequent Recurring or Merchant initiated payments of the same type, otherwise, the payments can be declined by the issuer. The TraceId represents the first, customer-present payment and helps the issuer to connect subsequent payments to this initial payment.

Example GetPaymentState response

{

"PaymentId": "2a9f3260bc2feb118bc3001dd8b71cc4",

"PaymentRequestId": "EXMPLSHOP-PM-001",

"OrderNumber": null,

"POSId": "[[SHOPS_PUBLIC_KEY]]",

"POSName": "[[MERCHANTS_BARION_SHOPNAME]]",

"POSOwnerEmail": "[[MERCHANTS_BARION_EMAIL]]",

"Status": "Succeeded",

"PaymentType": "Immediate",

"FundingSource": "BankCard",

"RecurrenceType": "MerchantInitiatedPayment",

"TraceId": "FGTRR55322843442124780",

"FundingInformation": {

"BankCard": {

"MaskedPan": "0425",

"BankCardType": "Visa",

"ValidThruYear": "2020",

"ValidThruMonth": "12"

},

"AuthorizationCode": "512244",

"ProcessResult": "Successful"

},

"AllowedFundingSources": [

"All"

],

"GuestCheckout": true,

"CreatedAt": "2020-11-26T07:52:48.9Z",

"ValidUntil": "2020-11-26T08:22:48.9Z",

"CompletedAt": "2020-11-26T08:11:54.118Z",

"ReservedUntil": null,

"DelayedCaptureUntil": null,

"Transactions": [

{

...

],

"Total": 25.20,

"SuggestedLocale": "hu-HU",

"FraudRiskScore": null,

"RedirectUrl": "https://merchanturl/Redirect?paymentId=2a9f3260bc2feb118bc3001dd8b71cc4",

"CallbackUrl": "https://merchanturl/Callback?paymentId=2a9f3260bc2feb118bc3001dd8b71cc4",

"Currency": "EUR",

"Errors": []

}Displaying the funding source in a GUI

We strongly advise saving the complete response for future reference. The FundingSource field tells if the funding source is a Barion balance or a card. If it is a card, it is useful to save FundingInformation for displaying it for the user, when requesting future payments. The usual way to display funding sources is to show the last 4 digits of the card, with 4 stars, eg: *** 1234. The card used can be obtained from FundingInformation's BankCard field. The CardType field can be used to display the appropriate card logo. You can even show, if the card is expired, and offer to register another one.

FundingInformation part of the GetPaymentState response

...

"FundingInformation": {

"BankCard": {

"MaskedPan": "0425",

"BankCardType": "Visa",

"ValidThruYear": "2020",

"ValidThruMonth": "12"

},

"AuthorizationCode": "512244",

"ProcessResult": "Successful"

}

...This can be displayed for example as VISA **** 0425 (12/20)

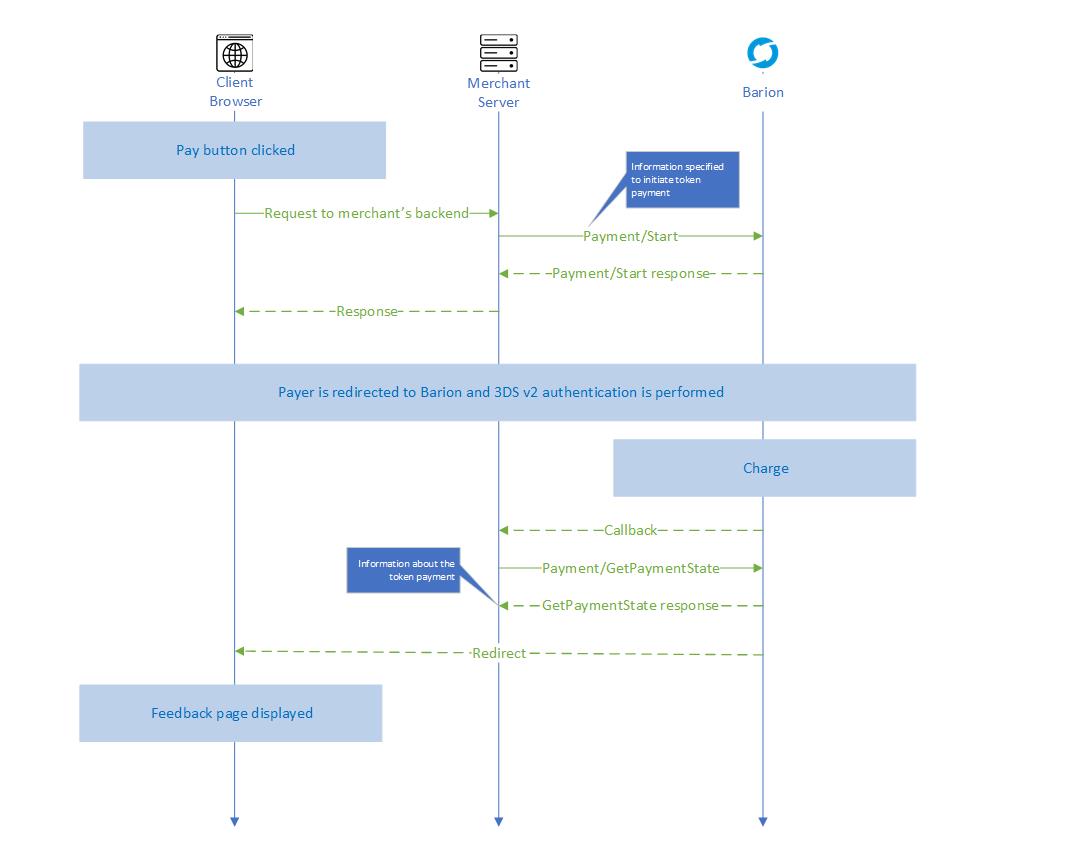

This is a request-response diagram of the token registration process:

Step 2: Using the token

To use an already registered token for a payment, you have to use the same /Payment/Start API endpoint but the InitiateRecurrence should be set to false. This tells the Barion API to use the token for payment instead of only registering it. The token should be specified in the RecurrenceId property. To be able to use a token, the initial payment must be in a successful state.

At this point, the merchant has to decide whether this subsequent payment is used for the same token payment scenario or something changed. This is important because the TraceId can only be used for the same scenario, otherwise, the card issuer will decline the charge.

A TraceId can only be used again if:

- the funding source is the same (technically the

RecurrenceIdis the same) - the token payment scenario is the same (technically the

RecurrenceTypeis the same) - this subsequent request complies with the scenario restrictions (eg: in case of recurring payment the amount of the subsequent payment does not exceed the initial amount)

If the funding source changes, new RecurrenceId must be requested. The process to do that is described in detail here. If the funding source stays the same but the scenario changes or the restrictions are no longer met new TraceId must be requested. The process to do that is described here.

Subsequent payments in case of Recurring payment scenario

In this case, three extra conditions must be met:

- the amount of the subsequent payment must not be higher than the initial amount

- at least that much days must be spent as defined in the initial

RecurringFrequencyproperty - the date of the payment must not exceed the day specified in the initial

RecurringExpiryproperty

Please be aware that in case any of these are no longer valid the merchant has to request a new TraceId as described here.

Payment/start must not include the RecurringFrequency and RecurringExpiry properties (since they are already fixed during the initial payment).

Example payment/start of a subsequent Recurring payment

{

"POSKey": "[[SECRET_POS_KEY]]",

"PaymentType": "Immediate",

"PaymentRequestId": "EXMPLSHOP-PM-002",

"InitiateRecurrence": false,

"RecurrenceId": "SHOP-XMLP-TOKEN-ABC-123",

"RecurrenceType": "RecurringPayment",

"TraceId": "FGTRR55322843442124780",

"FundingSources": ["All"],

"GuestCheckOut" : true,

"Currency": "EUR",

"Transactions": [

{

"POSTransactionId": "EXMPLSHOP-PM-002/TR001",

"Payee": "[[MERCHANTS_BARION_EMAIL]]",

"Total": 25.2,

"Comment": "Subscription fee for the second month",

"Items": [

{

"Name": "Website subscription",

"Description": "Website subscription for one month",

"Quantity": 1,

"Unit": "month",

"UnitPrice": 25.2,

"ItemTotal": 25.2,

"SKU": "EXMPLSHOP/SKU/PHC-02"

}

]

}

]

}Example response to this request

{

"PaymentId": "fb582913dc2feb11a49f309c23734b1c",

"PaymentRequestId": "EXMPLSHOP-PM-002",

"Status": "Succeeded",

"Transactions": [

...

],

"RecurrenceResult": "Successful",

"ThreeDSAuthClientData": null,

...

"TraceId": "FGTRR55322843442124780",

"Errors": []

}The structure of the response is the same as the normal /Payment/Start response just the statuses will be different. In this case

- the payment level

Statuswill be Succeeded instead of Prepared - the

RecurrenceResultwill be Successful (or Failed) instead of None

The value of the TraceId will be the same as in the request.

Subsequent payments in case of Merchant Initiated Payment scenario

In this scenario there are no restrictions.

Example payment/start of a subsequent Merchant Initiated Payment

{

"POSKey": "[[SECRET_POS_KEY]]",

"PaymentType": "Immediate",

"PaymentRequestId": "EXMPLSHOP-PM-002",

"InitiateRecurrence": false,

"RecurrenceId": "SHOP-XMLP-TOKEN-ABC-123",

"RecurrenceType": "MerchantInitiatedPayment",

"TraceId": "KBYRR55322844552124780",

"FundingSources": ["All"],

"GuestCheckOut" : true,

"Currency": "EUR",

"Transactions": [

{

"POSTransactionId": "EXMPLSHOP-PM-002/TR001",

"Payee": "[[MERCHANTS_BARION_EMAIL]]",

"Total": 75,

"Comment": "Usage fee for 2020/12",

"Items": [

{

"Name": "Phone bill",

"Description": "Usage fee for 2020/12",

"Quantity": 1,

"Unit": "month",

"UnitPrice": 75,

"ItemTotal": 75,

"SKU": "EXMPLSHOP/SKU/PHC-02"

}

]

}

]

}Example response to this request

{

"PaymentId": "fb582913dc2feb11a49f309c23734b1c",

"PaymentRequestId": "EXMPLSHOP-PM-002",

"Status": "Succeeded",

"Transactions": [

...

],

"RecurrenceResult": "Successful",

"ThreeDSAuthClientData": null,

...

"TraceId": "KBYRR55322844552124780",

"Errors": []

}The structure of the response is the same as the normal /Payment/Start response just the statuses will be different. In this case

- the payment level

Statuswill be Succeeded instead of Prepared - the

RecurrenceResultwill be Successful (or Failed) instead of None

The value of the TraceId will be the same as in the request.

Subsequent payments in case of OneClick Payment scenario

In this scenario, the merchant has to prepare to perform the off-site 3DS v2 authentication of the payer. 3DS authentication is not required in the following cases:

- the token (

RecurrenceId) was requested before 3DS came into effect, - the original payment was not initialized by bank card,

The TraceId is not used in this scenario since the payer is present during the transaction.

Example payment/start of a subsequent OneClick Payment

{

"POSKey": "[[SECRET_POS_KEY]]",

"PaymentType": "Immediate",

"PaymentRequestId": "EXMPLSHOP-PM-002",

"InitiateRecurrence": false,

"RecurrenceId": "SHOP-XMLP-TOKEN-ABC-123",

"RecurrenceType": "OneClickPayment",

"FundingSources": ["All"],

"GuestCheckOut" : true,

"Currency": "EUR",

"Transactions": [

{

"POSTransactionId": "EXMPLSHOP-PM-002/TR001",

"Payee": "[[MERCHANTS_BARION_EMAIL]]",

"Total": 17,

"Comment": "Book: How to shop online",

"Items": [

{

"Name": "How to shop online",

"Description": "Book about shopping online",

"Quantity": 1,

"Unit": "piece",

"UnitPrice": 17,

"ItemTotal": 17,

"SKU": "EXMPLSHOP/SKU/PHC-02"

}

]

}

]

}

Example response to this request

In this scenario, the response contains the ThreeDSAuthClientData property that is used to perform an off-site 3DS v2 authentication.

{

"PaymentId": "fb582913dc2feb11a49f309c23734b1c",

"PaymentRequestId": "EXMPLSHOP-PM-002",

"Status": "Succeeded",

"Transactions": [

...

],

"RecurrenceResult": "Successful",

"ThreeDSAuthClientData": "ewoJIkNhcmRQdWJs...WZXJzaW9uIjogIjIuMS4wIgp9Cg==",

...

"Errors": []

}Possible error responses for the subsequent payment requests

| Error code | Description |

|---|---|

| InvalidRecurrenceId | The token specified in the RecurrenceId is invalid. Check if the token registration was successful.

|

| RecurringPaymentDenied | Something happened to the user since the token registration, either deleted, suspended, or blocked. The payment s not allowed in these cases. |

| InsufficientFunds | If the original payment was with an e-money wallet and the customer doesn't have enough money to fulfill this charge this error happens. |

| OriginalPaymentWasntSuccessful | This means that the token belongs to an originally unsuccessful payment so this token can not be used anymore. This could only happen if the original payment was financed with a credit card. |

| InvalidCurrency | If the original payment was paid with e-money and the current token payment is in a currency that the wallet does not have an account in this error happens. |

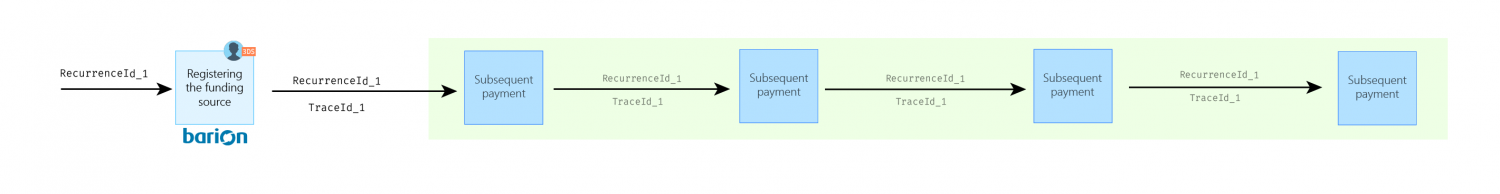

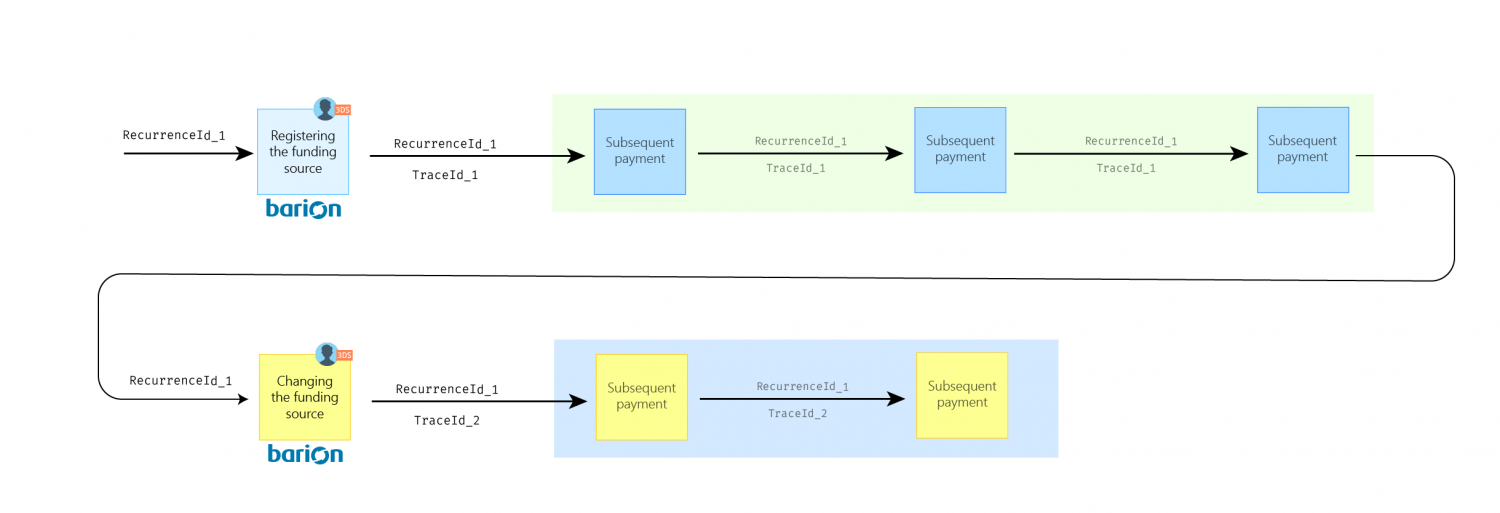

This is the request-response diagram of the subsequent payments:

Changing funding source or token scenarios

Changing the funding source

This could happen if the funding source becomes invalid for some reason (card gets deleted or expires) or the merchant decides to use that token for another payer. In this case, the merchant has to register the RecurrenceId again.

To do this a new payment must be started and in the Payment/Start request the following setup should be specified:

- the

InitiateRecurrencefield has to be set totrue - the

RecurrenceIdhas to be specified. - and the

TraceIdshould not be specified.

Since the TraceId is bound to the payer and the process if the funding source changes new TraceId will be generated. This new ID must be saved to this payment and must be used from this moment on for subsequent payments.

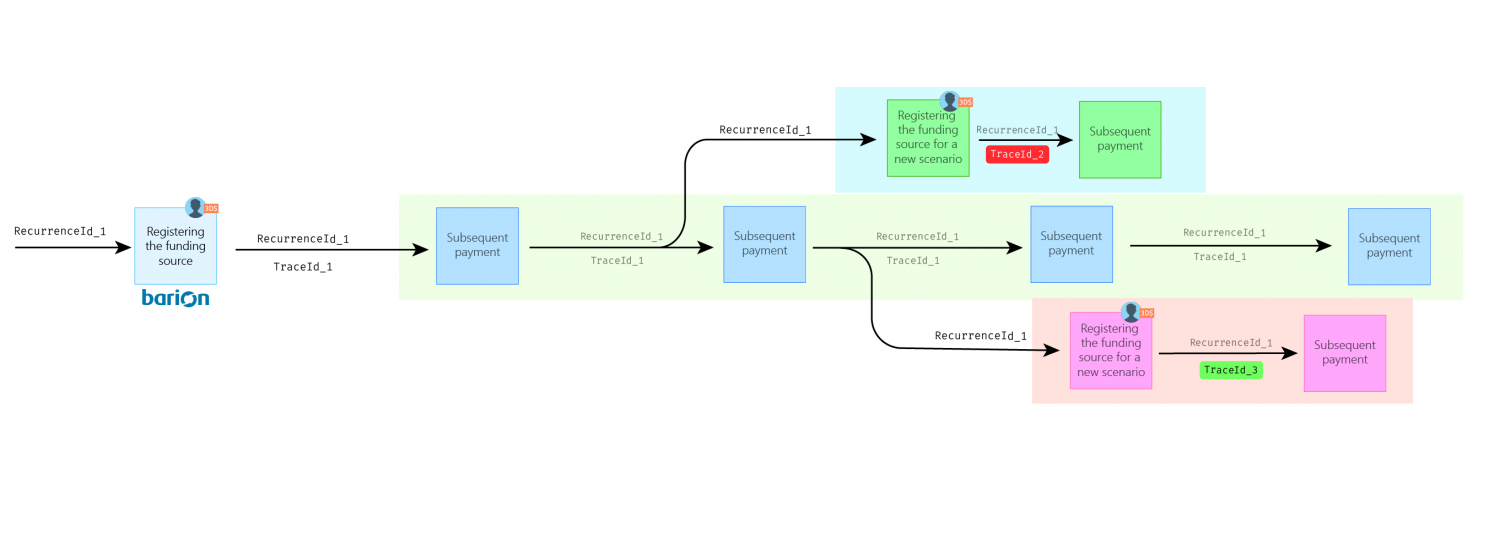

Changing the token payment scenario with an existing token

This could occur when the merchant wants to get authorization from the payer to a new token scenario for the already registered funding source. To be able to do this the merchant has to have a valid and registered RecurrenceId.

Let's see some examples when this may be necessary:

- The payer subscribed to the merchant's service beforehand and the merchant decided to use the recurring payment token scenario. The payer wants to subscribe to another service and this requires a different payment schedule. This means that the

RecurringFrequencythat was specified initially can not be maintained so it is required to acquire a newTraceId - The payer bought something on the merchant's website and uses the one-click feature for subsequent fast non-redirect payments. After a while, the payer decides to subscribe to a service provided by this same merchant. This means that the merchant has to create a new token scenario (not a one-click payment but a recurring payment). For this, the merchant has to acquire a new

TraceId. This can be done without redirecting the payer to Barion using the existingRecurrenceIdand performing a 3DS authentication on the merchant's website.

To do these a new payment must be started and in the Payment/Start request the following setup should be specified:

- the

InitiateRecurrencefield has to be set tofalse - the

RecurrenceIdhas to be specified. - and the

TraceIdshould not be specified.

After this, a 3DS authentication has to be completed to acquire a new trace ID. This can be done on the merchant's site if the merchant implements the barion.offsitegw.js for off-site 3DS authentication.

This means that it can be achieved to acquire different Trace IDs for different scenarios with only one RecurrenceId.

This is basically categorizing the different token scenarios as opposed to using every subsequent payment as an unmarked charge.

Off-site 3DS v2 authentication

In certain scenarios, the payer has to be authenticated to lower the risk of the card transaction. This can be either performed

- on the Barion Smart Gateway (on-site) by redirecting the customer to Barion

- or on the merchant's website (off-site) by integrating the Barion Off-site client library.

This section describes how to integrate the Barion off-site authentication library into the merchant's site.

Step 1 : Initialize the off-site authentication library

You have to include the following css and javascript files in the code of your site.

<link href="https://secure.barion.com/static/barion.offsitegw.min.css" rel="stylesheet">

<script src="https://secure.barion.com/static/barion.offsitegw.min.js"></script>These files include all the necessary javascript code and styling to handle the 3DS authentication and display the challenge if necessary.

Then you have to initialize the Barion javascript client. To do that, you have to define a configuration object that specifies your functions that handle the off-site authentication events.

Authentication events

onAuthenticationSucceeded: the 3DS v2 authentication successfully completedonAuthenticationFailed: the 3DS v2 authentication failed

const configuration = {

onAuthenticationSucceeded: function () {

// handle successful authentication by calling the Barion API via merchant's backend

// Call the v2/payment/complete endpoint

},

onAuthenticationFailed: function () {

// Handle unsuccessful authentication result, no charge was made.

// The payment might be still valid only the authentication failed

}

}Then you have to pass this config object to the library.

const gw = new Barion.OffsiteGw(configuration);Step 2: Start the authentication process

Once the ThreeDSAuthClientData is acquired from the payment/start you can start the authentication process by calling the authenticate() method of the library.

gw.authenticate(threeDsClientData);This will start the authentication process and present the challenge if needed. Visually this will create a modal window over the merchant's site and show the payer every necessary information. Once the authentication process finished (either with or without a challenge) the appropriate event will be fired.

Step 3: Completing the payment

In case of successful authentication, you have to call our /Payment/Complete endpoint, where the actual charge will happen.

Possible error responses for the subsequent payment requests

TODO

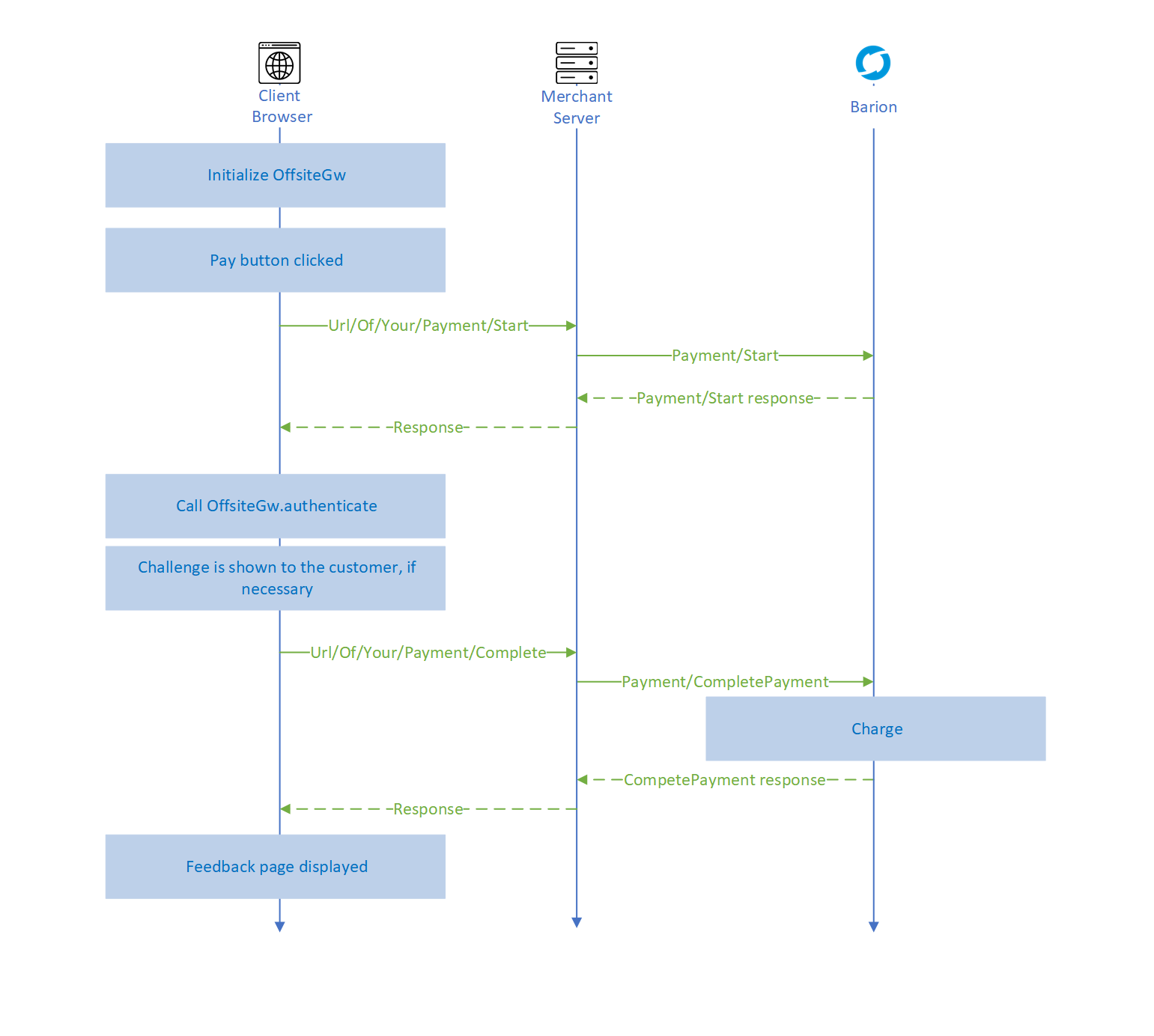

Suggested implementation flow for off-site authentication

Ideally, an off-site authentication should be part of a client-side experience without any postbacks or page reloads. This is our recommendation to achieve this:

- After the customer clicks on the "Pay" button make an AJAX call from your client-side code to your back-end.

- Have your backend make a request to our payment/start endpoint (with the appropriate settings for the desired token scenario)

- Have your backend process the response and pass the value of the

ThreeDSAuthClientDataproperty to your client-side code. - Use the Barion off-site library to perform the authentication

- Once the authentication succeeds send another AJAX request from your client-side code to your back-end.

- Have your back-end code call our /Payment/Complete

- Have your backend process the response and pass the result to your client-side code.

- Display the result for the customer

Testing the integration

3D Secure has no environment for end-to-end testing, therefore merchants have to split their testings into two parts: Testing the payment flow with and without challenge. Getting a challenge is only possible with real-life cards, merchants have to use their own (there will be no real charging at the end on the Sandbox of the Payment Gateway, but using a real card will result initiating a real 3DS authentication).

Testing the whole payment flow, without challenge

Use the OTP test cards (to-be-defined), they will always get a "frictionless" flow, where the 3DS process is presented on the UI, but you will never see a challenge screen.

This is good for testing your integration itself because it will lead to a successful charge, and you will get a TraceId as well.

Testing the challenge itself

Use your own card, and let the card issuer decide whether your payment will get a challenge or not during the 3DS authentication procedure. Your payment will fail at the end, and you won't get the TraceId.

This is good to test, how the challenge screens look like in your shop - especially when you integrated OneClick payment directly to your shop. You might also check how your customers see your checkout flow on popular devices.