Subscriptions: set up recurring billing: Difference between revisions

(→Create a token to represent the customer’s payment instrument: fixed json sample code) |

(added warning about TraceId with multiple whitespace characters, and removed the TraceId value from the sample) |

||

| (5 intermediate revisions by the same user not shown) | |||

| Line 2: | Line 2: | ||

{{TableOfContents}} | {{TableOfContents}} | ||

Find out how to use the Barion Gateway API to set up a subscription – billing your customer at regular intervals for an ongoing service. In a subscription, a Barion shop is authorized by the customer to charge the customer’s specific payment instrument the same amount at predefined intervals, until a predefined future date. | Find out how to use the Barion Gateway API to set up a subscription – billing your customer at regular intervals for an ongoing service. In a subscription, a Barion shop is authorized by the customer to charge the customer’s specific payment instrument the same amount at predefined intervals, until a predefined future date. | ||

{{NotificationBox|title=Note|text=The transactions in subscription payments aren’t automated – the feature lets you as a merchant set up the intervals and amounts, but you’ll still have to explicitly charge your customer.|color=#1993c7}} | |||

== Prerequisites == | == Prerequisites == | ||

* a Barion Wallet with a balance in the currency of the payment | * a Barion Wallet with a balance in the currency of the payment | ||

| Line 11: | Line 9: | ||

* an approved request to Barion to allow recurring payment scenarios in the Barion shop | * an approved request to Barion to allow recurring payment scenarios in the Barion shop | ||

=== Enable token payment scenarios for your Barion shop === | === Enable token payment scenarios for your Barion shop === | ||

{{NotificationBox|title=Note|text=Recurring payments are enabled by default in [[Sandbox|the Barion Sandbox environment]].|color=#1993c7}} | |||

<ol><li> | |||

Make sure that your webshop meets the following criteria for recurring payment scenarios:<ul><li>your customers are prompted to explicitly consent before you trigger the payment scenario</li> | |||

<li>your customers are informed about how they can change their mind about the scenario</li></ul> | <li>your customers are informed about how they can change their mind about the scenario</li></ul> | ||

</ | {{NotificationBox|title=Note|text=[https://www.barion.com/en/help/business/open-and-manage-a-shop/can-i-collect-fees-from-my-customers-on-a-monthly-basis/ Read the full list of Barion's criteria for enabling recurring payments for a Barion shop].|color=#1993c7}} | ||

</li> | |||

<li>Ask Barion customer support for details about enabling the feature, and to request recurring payments using the Customer service tab in your Barion Wallet, or the "Other>Help" screen in the Barion app.</li></ol> | |||

== Create a token to represent the customer’s payment instrument == | == Create a token to represent the customer’s payment instrument == | ||

<blockquote>Note that you need to request and receive consent from the customer [https://www.barion.com/en/help/business/open-and-manage-a-shop/can-i-collect-fees-from-my-customers-on-a-monthly-basis/ in a way that meets Barion’s relevant requirements], before you can register their payment instrument with Barion. | <blockquote>Note that you need to request and receive consent from the customer [https://www.barion.com/en/help/business/open-and-manage-a-shop/can-i-collect-fees-from-my-customers-on-a-monthly-basis/ in a way that meets Barion’s relevant requirements], before you can register their payment instrument with Barion.</blockquote> | ||

</blockquote> | |||

When you’d like to set up a recurring payment using a customer’s specific payment instrument, do the following. | When you’d like to set up a recurring payment using a customer’s specific payment instrument, do the following. | ||

<ol style="list-style-type: decimal;"> | <ol style="list-style-type: decimal;"> | ||

<li><p>Make a call to [[Payment-Start-v2|the Payment start API endpoint]] with the following four extra properties:</p> | <li><p>Make a call to [[Payment-Start-v2|the Payment start API endpoint]] with the following four extra properties:</p> | ||

{{NotificationBox|title=Note|text=The <code>PurchaseInformation</code> property, unique to recurring payments, is a structured property with nested properties of its own.|color=#1993c7}} | |||

<ul> | <ul> | ||

<li><p><code>InitiateRecurrence</code>: <code>true</code></p></li> | <li><p><code>InitiateRecurrence</code>: <code>true</code></p></li> | ||

<li><p><code>RecurrenceId</code>: <the unique token that you generate and save for the customer’s payment instrument></p> | <li><p><code>RecurrenceId</code>: <the unique token that you generate and save for the customer’s payment instrument></p> | ||

<blockquote | <blockquote>Multiple shops can share the same token – [mailto:[email protected] get in touch with Merchant Helpdesk] for details.</blockquote> | ||

</li> | |||

<li><p><code>RecurrenceType</code>: <code>RecurringPayment</code></p></li> | <li><p><code>RecurrenceType</code>: <code>RecurringPayment</code></p></li> | ||

<li><p><code>PurchaseInformation</code></p> | <li><p><code>PurchaseInformation</code></p> | ||

| Line 32: | Line 34: | ||

<li><p><code>RecurringFrequency</code>: The minimum number of days between two payments with the specified <code>RecurrenceId</code>.</p></li></ul> | <li><p><code>RecurringFrequency</code>: The minimum number of days between two payments with the specified <code>RecurrenceId</code>.</p></li></ul> | ||

</li></ul> | </li></ul> | ||

{{NotificationBox|title=Note|text=The <code>RecurrenceResult</code> property, which indicates the status of the token registration is <code>None</code> at this stage, because the registration of a payment instrument effectively happens when the customer selects the given payment instrument on the Barion Smart Gateway UI.|color=#1993c7}} | |||

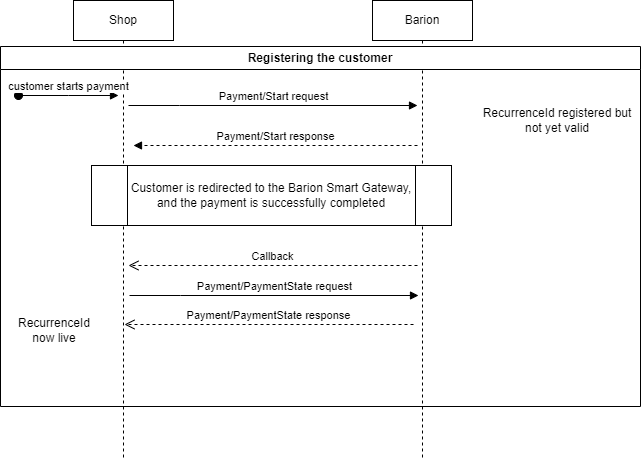

[[File:Recurring.png|alt=Overview of how the token (RecurrenceId) is registered | |||

</ | [[File:Recurring registering.png|alt=Overview of how the token (RecurrenceId) is registered|Overview of how the token (RecurrenceId) is registered]] | ||

<br/> | |||

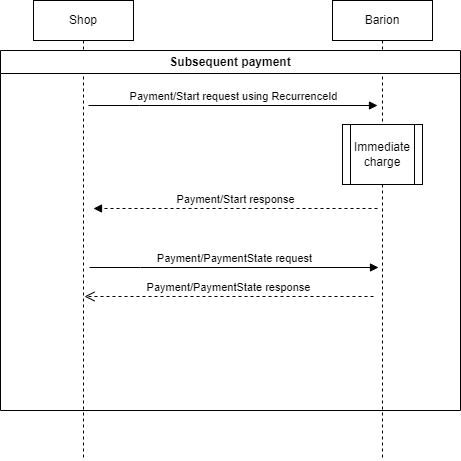

[[File:Recurring subsequent.png|alt=Overview of how the RecurrenceId is used in a subsequent subscription payment|Overview of how the RecurrenceId is used in a subsequent subscription payment]] | |||

{{NotificationBox|title=Note|text=If the endpoint responds with the <code>RecurringPaymentNotAllowed</code> error code, get in touch with Barion customer support.|color=#1993c7}} | |||

</li> | |||

<li><p>[[Callback mechanism|Process the payment callback]] as usual.</p> | <li><p>[[Callback mechanism|Process the payment callback]] as usual.</p> | ||

</li> | </li> | ||

<li><p>Query [[Payment-PaymentState-v4|the payment state endpoint]], and store the <code>TraceId</code> in its response.</p> | <li><p>Query [[Payment-PaymentState-v4|the payment state endpoint]], and store the <code>TraceId</code> in its response.</p> | ||

<p>Make sure you store the <code>TraceId</code> as-is, including whitespace characters – often the identifier includes multiple spaces or symbols; this is normal.</p> | |||

<syntaxhighlight lang="json"> | <syntaxhighlight lang="json"> | ||

{ | { | ||

| Line 52: | Line 59: | ||

"FundingSource": "BankCard", | "FundingSource": "BankCard", | ||

"RecurrenceType": "RecurringPayment", | "RecurrenceType": "RecurringPayment", | ||

"TraceId": " | "TraceId": "[this is the important line]", | ||

"FundingInformation": { | "FundingInformation": { | ||

"BankCard": { | "BankCard": { | ||

| Line 82: | Line 89: | ||

} | } | ||

</syntaxhighlight> | </syntaxhighlight> | ||

{{NotificationBox|title=Note|text=If the tokenized payment instrument is a Barion Wallet balance, a <code>TraceId</code> is unnecessary, and won’t be returned in the payment state endpoint response.|color=#1993c7}} | |||

<p>This value is crucial to recurring payments, as it represents the payment instrument for the given recurring payment scenario in subsequent transactions.</p> | <p>This value is crucial to recurring payments, as it represents the payment instrument for the given recurring payment scenario in subsequent transactions.</p> | ||

<p>You’ll need to provide it for every subsequent payment in the recurring payment that you’ve just set up.</p> | <p>You’ll need to provide it for every subsequent payment in the recurring payment that you’ve just set up.</p> | ||

{{NotificationBox|title=Note|text=Best practice is to also store the <code>FundingSource</code> and <code>FundingInformation</code> values in the payment state response – these indicate the type of payment method and the description of the payment instrument that the customer has selected for the payment, and so the payment instrument that the <code>RecurrenceId</code> token will represent in future payments.|color=#1993c7}} | |||

</li></ol> | |||

== Use the registered token for recurring payments == | == Use the registered token for recurring payments == | ||

| Line 95: | Line 103: | ||

* at least a number of days specified in the <code>RecurringFrequency</code> property must elapse between two payments in a recurring scenario | * at least a number of days specified in the <code>RecurringFrequency</code> property must elapse between two payments in a recurring scenario | ||

* the date of a payment in a recurring payment scenario can’t be later than the specified <code>RecurringExpiry</code> property | * the date of a payment in a recurring payment scenario can’t be later than the specified <code>RecurringExpiry</code> property | ||

{{NotificationBox|title=Note|text=You can switch to a different payment scenario if the above conditions are no longer met, by requesting a new <code>TraceId</code> for the customer’s payment instrument.|color=#1993c7}} | |||

=== Steps === | === Steps === | ||

<ol style="list-style-type: decimal;"> | <ol style="list-style-type: decimal;"> | ||

| Line 105: | Line 112: | ||

<li><code>RecurrenceType: RecurringPayment</code>, and</li> | <li><code>RecurrenceType: RecurringPayment</code>, and</li> | ||

<li><code>InitiateRecurrence: false</code>.</li></ul> | <li><code>InitiateRecurrence: false</code>.</li></ul> | ||

{{NotificationBox|title=Note|text=Don’t pass a <code>PurchaseInformation</code> property – you’ve already fixed the values of its sub-properties during the initial token-registering payment.|color=#1993c7}} | |||

<syntaxhighlight lang="json"> | <syntaxhighlight lang="json"> | ||

{ | { | ||

| Line 143: | Line 150: | ||

<syntaxhighlight lang="json"> | <syntaxhighlight lang="json"> | ||

{ | { | ||

"PaymentId": "fa2bf7469358ef118c0c001dd8b71cc5", | |||

"PaymentRequestId": "TEST-15", | |||

"Status": "Succeeded", | |||

"QRUrl": "https://api.test.barion.com/qr/generate?paymentId=fa2bf746-9358-ef11-8c0c-001dd8b71cc5&size=Large", | |||

"Transactions": [ | |||

{ | |||

"POSTransactionId": "TEST-15-02", | |||

"TransactionId": "fb2bf7469358ef118c0c001dd8b71cc5", | |||

"Status": "Succeeded", | |||

"Currency": "HUF", | |||

"TransactionTime": "2024-08-12T10:11:46.253", | |||

"RelatedId": null | |||

}, | |||

{ | |||

"POSTransactionId": null, | |||

"TransactionId": "fd2bf7469358ef118c0c001dd8b71cc5", | |||

"Status": "Reserved", | |||

"Currency": "HUF", | |||

"TransactionTime": "2024-08-12T10:11:46.253", | |||

"RelatedId": null | |||

} | |||

], | |||

"RecurrenceResult": "Successful", | |||

"ThreeDSAuthClientData": null, | |||

"GatewayUrl": "https://secure.test.barion.com/Pay?Id=fa2bf7469358ef118c0c001dd8b71cc5", | |||

"RedirectUrl": "https://example.com/?paymentId=fa2bf7469358ef118c0c001dd8b71cc5", | |||

"CallbackUrl": "", | |||

"TraceId": null, | |||

"Errors": [] | |||

} | } | ||

</syntaxhighlight> | </syntaxhighlight> | ||

| Line 178: | Line 193: | ||

|None | |None | ||

|No token payment was requested (<code>InitiateRecurrence</code> was omitted, or set to <code>true</code>).<br/>Repeat steps 1–2, making sure to pass <code>InitiateRecurrence: true</code>. | |No token payment was requested (<code>InitiateRecurrence</code> was omitted, or set to <code>true</code>).<br/>Repeat steps 1–2, making sure to pass <code>InitiateRecurrence: true</code>. | ||

|- | |- | ||

|NotFound | |NotFound | ||

| Line 239: | Line 251: | ||

<li><p><code>RecurrenceId</code>: <code><the original token></code></p></li> | <li><p><code>RecurrenceId</code>: <code><the original token></code></p></li> | ||

<li><p><code>RecurrenceType</code>: <code><the value first used></code></p></li></ul> | <li><p><code>RecurrenceType</code>: <code><the value first used></code></p></li></ul> | ||

{{NotificationBox|title=Note|text=Make sure not to include a <code>TraceId</code> property.|color=#1993c7}} | |||

<li><p>[[Callback mechanism|Wait for the callback]] and verify that the customer paid the order.</p></li> | <li><p>[[Callback mechanism|Wait for the callback]] and verify that the customer paid the order.</p></li> | ||

<li><p>Query [[Payment-PaymentState-v4|the payment state endpoint]], and store the newly-generated <code>TraceId</code> that the endpoint returns.</p></li> | <li><p>Query [[Payment-PaymentState-v4|the payment state endpoint]], and store the newly-generated <code>TraceId</code> that the endpoint returns.</p></li> | ||

<li><p>Use the new <code>TraceId</code> for subsequent payments as before.</p></li></ol> | <li><p>Use the new <code>TraceId</code> for subsequent payments as before.</p></li></ol> | ||

Latest revision as of 09:47, 13 August 2024

Subscriptions: set up recurring billing

Find out how to use the Barion Gateway API to set up a subscription – billing your customer at regular intervals for an ongoing service. In a subscription, a Barion shop is authorized by the customer to charge the customer’s specific payment instrument the same amount at predefined intervals, until a predefined future date.

Prerequisites

- a Barion Wallet with a balance in the currency of the payment

- an active Barion shop

- an approved request to Barion to allow recurring payment scenarios in the Barion shop

Enable token payment scenarios for your Barion shop

-

Make sure that your webshop meets the following criteria for recurring payment scenarios:

- your customers are prompted to explicitly consent before you trigger the payment scenario

- your customers are informed about how they can change their mind about the scenario

- Ask Barion customer support for details about enabling the feature, and to request recurring payments using the Customer service tab in your Barion Wallet, or the "Other>Help" screen in the Barion app.

Create a token to represent the customer’s payment instrument

Note that you need to request and receive consent from the customer in a way that meets Barion’s relevant requirements, before you can register their payment instrument with Barion.

When you’d like to set up a recurring payment using a customer’s specific payment instrument, do the following.

Make a call to the Payment start API endpoint with the following four extra properties:

NoteThePurchaseInformationproperty, unique to recurring payments, is a structured property with nested properties of its own.InitiateRecurrence:trueRecurrenceId: <the unique token that you generate and save for the customer’s payment instrument>Multiple shops can share the same token – get in touch with Merchant Helpdesk for details.

RecurrenceType:RecurringPaymentPurchaseInformationRecurringExpiry: The locale-specific date past which no subsequent charges are accepted for the payment instrument using the specifiedRecurrenceId.RecurringFrequency: The minimum number of days between two payments with the specifiedRecurrenceId.

NoteTheRecurrenceResultproperty, which indicates the status of the token registration isNoneat this stage, because the registration of a payment instrument effectively happens when the customer selects the given payment instrument on the Barion Smart Gateway UI.NoteIf the endpoint responds with theRecurringPaymentNotAllowederror code, get in touch with Barion customer support.Process the payment callback as usual.

Query the payment state endpoint, and store the

TraceIdin its response.Make sure you store the

TraceIdas-is, including whitespace characters – often the identifier includes multiple spaces or symbols; this is normal.{ "PaymentId": "093a87ea9158ef118c0c001dd8b71cc5", "PaymentRequestId": "TEST-01", "OrderNumber": null, "POSId": "your-POSKey", "POSName": "Modify Name", "POSOwnerEmail": "[email protected]", "POSOwnerCountry": "HU", "Status": "Succeeded", "PaymentType": "Immediate", "FundingSource": "BankCard", "RecurrenceType": "RecurringPayment", "TraceId": "[this is the important line]", "FundingInformation": { "BankCard": { ... }, "AuthorizationCode": "iw5q3o", "ProcessResult": "Successful" }, "AllowedFundingSources": [ "All" ], "GuestCheckout": true, ... "Transactions": [ { "TransactionId": "0a3a87ea9158ef118c0c001dd8b71cc5", ... }, { "TransactionId": "fd9cbd5c9258ef118c0c001dd8b71cc5", ... } ], "Total": 100.00, ... "Currency": "HUF", "PaymentMethod": "BankCard", "Errors": [] }NoteIf the tokenized payment instrument is a Barion Wallet balance, aTraceIdis unnecessary, and won’t be returned in the payment state endpoint response.This value is crucial to recurring payments, as it represents the payment instrument for the given recurring payment scenario in subsequent transactions.

You’ll need to provide it for every subsequent payment in the recurring payment that you’ve just set up.

NoteBest practice is to also store theFundingSourceandFundingInformationvalues in the payment state response – these indicate the type of payment method and the description of the payment instrument that the customer has selected for the payment, and so the payment instrument that theRecurrenceIdtoken will represent in future payments.

Use the registered token for recurring payments

Prerequisites

Unless the tokenized payment instrument is a Barion Wallet balance, you’ll need a TraceId from a successful recurrence-initializing payment for all subsequent payments in a recurring payment scenario.

There are three conditions that need to be met for a recurring payment transaction to be successful:

- the amount in the subsequent payment can’t exceed the original payment where the token was set up

- at least a number of days specified in the

RecurringFrequencyproperty must elapse between two payments in a recurring scenario - the date of a payment in a recurring payment scenario can’t be later than the specified

RecurringExpiryproperty

TraceId for the customer’s payment instrument.Steps

Call the Payment start Barion API endpoint, and pass it:

- the

TraceId(if the call to the payment state endpoint after the initial payment returned one) - the registered

RecurrenceId, RecurrenceType: RecurringPayment, andInitiateRecurrence: false.

NoteDon’t pass aPurchaseInformationproperty – you’ve already fixed the values of its sub-properties during the initial token-registering payment.{ "POSKey": "[[SECRET_POS_KEY]]", "PaymentType": "Immediate", "PaymentRequestId": "EXMPLSHOP-PM-002", "InitiateRecurrence": false, "RecurrenceId": "SHOP-XMLP-TOKEN-ABC-123", "RecurrenceType": "RecurringPayment", "TraceId": "FGTRR55322843442124780", "FundingSources": ["All"], "GuestCheckOut" : true, "Currency": "EUR", "Transactions": [ { "POSTransactionId": "EXMPLSHOP-PM-002/TR001", "Payee": "[[MERCHANTS_BARION_EMAIL]]", "Total": 25.2, "Comment": "Subscription fee for the second month", "Items": [ { "Name": "Website subscription", "Description": "Website subscription for one month", "Quantity": 1, "Unit": "month", "UnitPrice": 25.2, "ItemTotal": 25.2, "SKU": "EXMPLSHOP/SKU/PHC-02" } ] } ] }- the

Check the

RecurrenceResultproperty in the payment start endpoint response, which indicates whether the token registration had been successful:A generic Payment/Start API endpoint response:

{ "PaymentId": "fa2bf7469358ef118c0c001dd8b71cc5", "PaymentRequestId": "TEST-15", "Status": "Succeeded", "QRUrl": "https://api.test.barion.com/qr/generate?paymentId=fa2bf746-9358-ef11-8c0c-001dd8b71cc5&size=Large", "Transactions": [ { "POSTransactionId": "TEST-15-02", "TransactionId": "fb2bf7469358ef118c0c001dd8b71cc5", "Status": "Succeeded", "Currency": "HUF", "TransactionTime": "2024-08-12T10:11:46.253", "RelatedId": null }, { "POSTransactionId": null, "TransactionId": "fd2bf7469358ef118c0c001dd8b71cc5", "Status": "Reserved", "Currency": "HUF", "TransactionTime": "2024-08-12T10:11:46.253", "RelatedId": null } ], "RecurrenceResult": "Successful", "ThreeDSAuthClientData": null, "GatewayUrl": "https://secure.test.barion.com/Pay?Id=fa2bf7469358ef118c0c001dd8b71cc5", "RedirectUrl": "https://example.com/?paymentId=fa2bf7469358ef118c0c001dd8b71cc5", "CallbackUrl": "", "TraceId": null, "Errors": [] }RecurrenceResult value Description Successful The token had been registered successfully to the payment instrument that the customer used to complete the initial payment.

The token had been registered successfully to the payment instrument that the customer used to complete the initial payment.

The subsequent payment is paid for using the token that now represents the customer’s payment instrument.Failed The token won’t work. Check the call details, and try again. None No token payment was requested ( InitiateRecurrencewas omitted, or set totrue).

Repeat steps 1–2, making sure to passInitiateRecurrence: true.NotFound The RecurrenceId sent with the query wasn’t recognized.

Troubleshoot subsequent payments

Here’s the list of possible error codes that subsequent recurring payments can trigger, and how best to deal with them.

| Error code | Description |

|---|---|

| InvalidRecurrenceId | The registered token was found to be invalid. This is usually because the token’s registration had failed. Try again from the top. |

| RecurringPaymentDenied | The user associated with the token had been deleted, suspended, or blocked since the token was registered. |

| InsufficientFunds | The Barion Wallet that the token represents doesn’t have enough funds to fulfill the charge. |

| OriginalPaymentWasntSuccessful | The payment where the bank card that the token represents was registered didn’t itself succeed, which had invalidated the token. |

| InvalidCurrency | The Barion Wallet that the token represents doesn’t have a balance in the currency that the current payment requires. |

| CardExpired | The bank card that whose token was registered had since expired. Re-initialize the original RecurrenceId to fix this. |

| TopUpFailed | This is an error code that isn’t relevant to the scenario, but which might still pop up. It’s usually accompanied by another more specific error code. |

| ThreeDSNotEnabled | The issuer rejected the tokenized bank card because of a lack of Strong Customer Authentication. |

| InvalidUser | The source Barion Wallet doesn’t exist or isn’t fully activated. |

| UserCantMakeOutgoingTransaction | The source Barion Wallet is suspended or doesn’t exist. |

| CardError | An error occurred in either the 3DS authentication system or the bank system when processing the tokenized bank card. There can be several causes for this, from security settings to active limits on the card. You’ll need to reach out to the customer to troubleshoot the issue. |

| PingFailed | The bank or other third party didn’t respond to the request, so the Barion Payment API cancelled it. Try again later. |

Troubleshoot an invalidated payment instrument

If the payment instrument you’ve registered has become invalid since the initial payment (expires, gets reported as lost, etc.), you’ll need to re-register the payment instrument’s RecurrenceId to go on using it in the scenario.

Make a call to the the Payment start API endpoint with the following properties:

InitiateRecurrence: trueRecurrenceId:<the original token>RecurrenceType:<the value first used>

NoteMake sure not to include aTraceIdproperty.Wait for the callback and verify that the customer paid the order.

Query the payment state endpoint, and store the newly-generated

TraceIdthat the endpoint returns.Use the new

TraceIdfor subsequent payments as before.