Facilitated payments: Difference between revisions

m (Vinczei moved page Marketplace to Facilitated payments) |

No edit summary |

||

| Line 47: | Line 47: | ||

== Refunding facilitated payments == | == Refunding facilitated payments == | ||

When using facilitated payments, refund is a special case. As long as a reservation payment is not finished, the facilitator has complete control of the process and is able to refund the amount by finishing the payment transactions with zero amount. However, in case of a completed immediate or a finished reservation payment, the facilitator no longer has control over the process. This means that incurring refunds must be done by the seller. The facilitator and the seller must ensure the legal compliance of this in their respective environment. | When using facilitated payments, refund is a special case. As long as a reservation payment is not finished, the facilitator has complete control of the process and is able to refund the amount by finishing the payment transactions with zero amount. However, in case of a completed immediate or a finished reservation payment, the facilitator no longer has control over the process. This means that incurring refunds must be done by the seller. The facilitator and the seller must ensure the legal compliance of this in their respective environment. | ||

For a detailed example of Marketplace please check out [[Marketplace_Example|Detailed example of a marketplace payment]]. | |||

== Reference == | == Reference == | ||

Revision as of 09:42, 19 January 2018

Marketplace, sharing economy, and facilitated payments

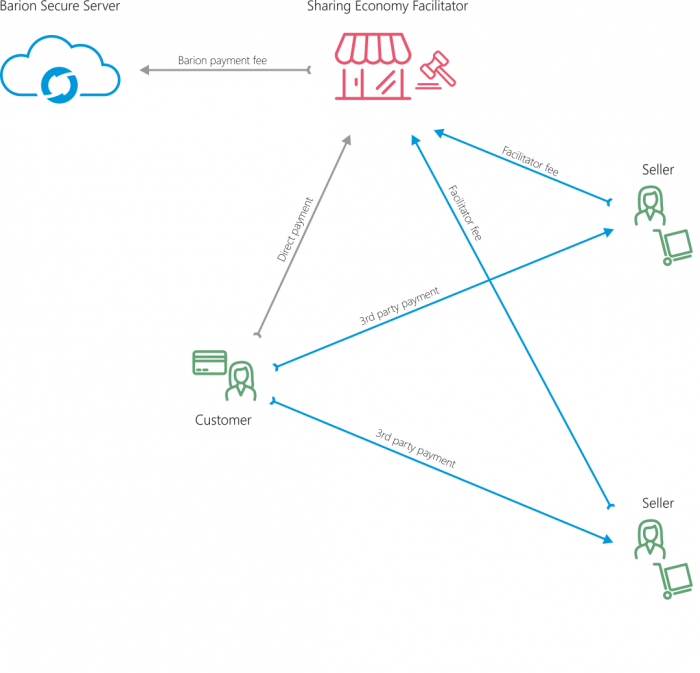

Payment facilitation is a special kind of payment scenario, where the payment itself is supervised by a third party. This means that a supervising shop (called the facilitator) defines all parameters for a payment, but it does not take part in the process as a payee. This is useful in marketplace and sharing economy scenarios, where the customer buys products and services from various sellers, under the management of a service provider. The service provider may also charge fees for the service that is paid by the seller.

Example: consider calling an Uber - the car driver is the seller, the passenger is the customer, and the company Uber is the facilitator. The money travels between the passenger and the driver, while the company deducts a fee from the driver.

Prerequisites

To successfully implement facilitated payments, you need to familiarize yourself with the simple Responsive Web Payment scenario, and, in case you wish to combine it with the reservation feature, also Reservation payments. The preparation of payments, redirection to the Barion Smart Gateway and handling the Callback mechanism are identical to all other scenarios.

The marketplace scenario

The payment process is similar to all other scenarios. The only difference is that the API calls are placed by the facilitator. Neither the customer nor the payee takes any action.

The basic structure of a facilitated payment consists of the facilitator, the customer, and one or more sellers. See the figure below.

Seller accounts

When taking part in a facilitated payment, the seller (payee) must have a registered, activated Barion wallet. They do not need to have a shop though.

Good to know: if the seller does not have an account with the payment's currency, it will automatically be created for them upon successful payment.

The lifecycle of a facilitated payment

1. The facilitator prepares the payment

Preparing the payment is identical to the Responsive Web Payment scenario. The facilitator specifies the payee[s], and the optional payment parameters.

2. The customer completes the payment

After the customer completes the payment via the Barion Smart Gateway, the money is transferred to the facilitator. A callback is sent to the facilitator.

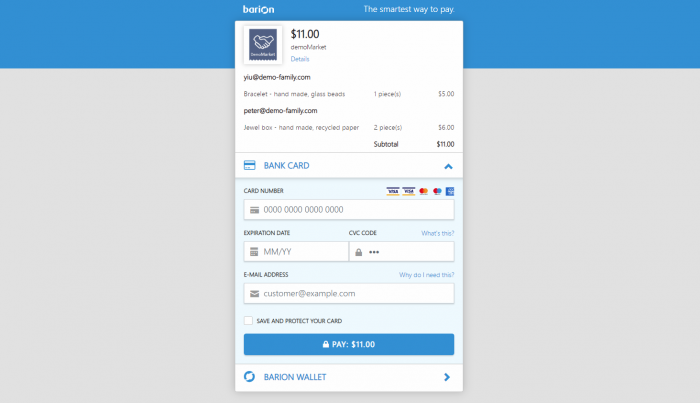

On the Barion Smart Gateway user interface the customer will see that the payee is the facilitator, while the sellers and items are listed in the payment details

3. The sellers receive the money

The Barion system distributes the paid amount among the sellers, according to the payment transactions specified by the facilitator when preparing the payment, and also processes all payee transactions (if applicable).

- At this point the location and availability of the money depends on wether the facilitator uses Immediate or Reservation payments. See the corresponding article for details.

Refunding facilitated payments

When using facilitated payments, refund is a special case. As long as a reservation payment is not finished, the facilitator has complete control of the process and is able to refund the amount by finishing the payment transactions with zero amount. However, in case of a completed immediate or a finished reservation payment, the facilitator no longer has control over the process. This means that incurring refunds must be done by the seller. The facilitator and the seller must ensure the legal compliance of this in their respective environment.

For a detailed example of Marketplace please check out Detailed example of a marketplace payment.