Payment monitor dashboard

Payment monitor dashboard

Track payments in your Barion shop and reference their details.

The payment monitor table

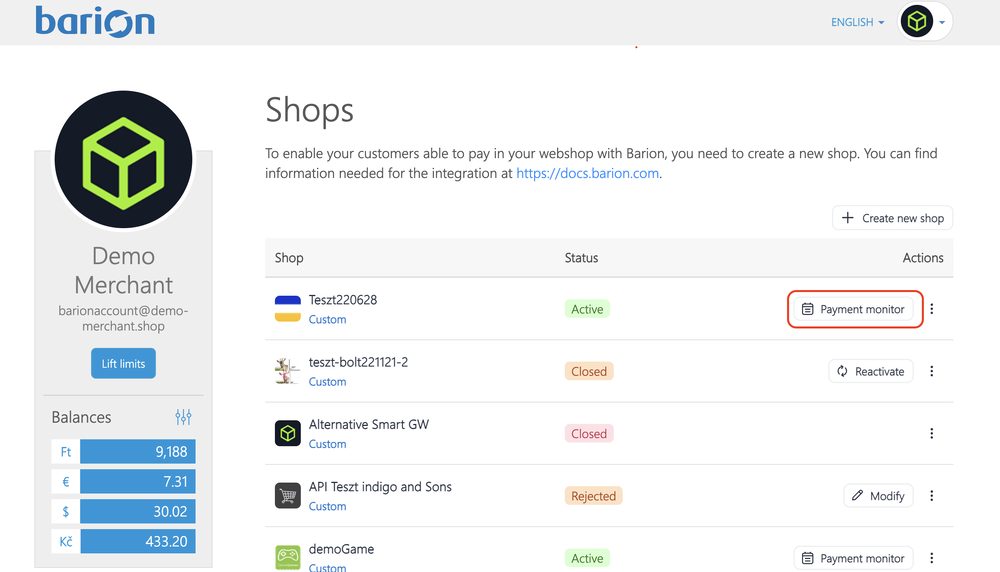

You can access the payment monitor dashboard for your shop by logging in to your Barion account, and clicking through to Shops>Payment monitor. Each shop has a separate payment monitor dashboard.

Columns

Modification date

The date and time of the latest change to the payment, in the currently-logged-in user's time zone and locale's date and time format.

Payment identifier

The unique identifier that Barion generated and assigned to the payment.

Payment request identifier

The identifier that you are using to identify the payment.

Payer email address

The email address supplied with the last payment attempt associated with the payment, regardless of whether it was successful or not. This field is only populated if there was at least one payment attempt made.

Created at

The date and time that the payment was created (and the payment identifier assigned) in the Barion system, in the currently-logged-in user's time zone and locale's date and time format.

Amount

The amount of money requested in the payment, displayed according to the currently-logged-in user's locale.

Currency

The ISO 4217 three-letter currency code that identifies the currency of the payment request. Supported values are HUF, EUR, USD, CZK.

Fraud risk score

A numeric value ranging between 0.00 and 100.00, indicating the risk of fraud as estimated by a dedicated third-party provider. The lower the score, the less likely the possibility of fraud is in relation to the payment. Note that unless you ask for a TRA exemption for your customer when requesting the payment through the gateway, this column will be blank. Payments with a fraud risk score below 10 are automatically granted a TRA exemption. The exemption request for a payment with fraud risk score above 30 is automatically rejected, and the payer has to go through strong customer authentication. In case a payment gets a fraud risk score between 10 and 30, you, the merchant who requested the exemption, will be notified in an email and in your account history that the payment has a medium-level fraud risk. It's up to you to honor the purchase or refund medium fraud risk payments, but you'll be held liable in case of fraud.

Status

The current status of the payment. When the status of a payment changes during the payment process, its record in the payment monitor table is updated. This column value determines whether the payment record is displayed with a red, green, or white background.

| Status | Description | Final? | Highlight color |

|---|---|---|---|

| Prepared | The payment is created and can be completed. | No | White |

| Started | The payer has started completing the payment. | No | White |

| In progress | The payment is being processed. | No | White |

| Waiting | Only applicable to bank transfers. The result of the bank transfer isn't yet available. | No | White |

| Reserved | Only applicable to reservation type payments. The payer completed the payment, and the payee receives the amount immediately, but it's blocked on their account until the payment is finalized before the reservation period is over. If the reserved payment isn't finalized within the reservation period, the amount is refunded to the payer. | No | White |

| Authorized | Only applicable to delayed capture type payments. The payer completed the payment. If the payment is captured within the capture period, their funding source will be charged. | No | White |

| Canceled by user | The payer explicitly canceled the payment request. | Yes | Red |

| Succeeded | The payment is fully completed. | Yes | Green |

| Failed | Only applicable to bank transfers. The payment was unsuccessful | Yes | Red |

| Expired | The payment hasn't been completed within the payment window, captured within the capture period, or finalized within the reservation period. | Yes | Red |

For a detailed duscussion of possible payment statuses and how they are related, see the diagrams on this page.

Type of payment

The payment scenario that applies to the payment. Possible values are "Immediate", "Reservation", and "Delayed capture". Read more about reservation payments and delayed capture scenarios.

Filtering table columns

Click the funnel icon in the top right of each column to display filter options (equals to, starts with, contains, etc.). Use these, and the AND/OR operator to construct a filter condition, and display only records with certain column values.

Payment record details

Record overview

For record details also displayed in the payment monitor table, see the discussion of the table.

Paid with

The payment source used for the payment: the last four digits of the card, the email address of the Barion wallet, or the bank account number.

Payer

The email address of the payer, and whether the address is associated with a Barion wallet.

Original total

The amount of money that the payer has paid as part of the payment.

Current total

The amount of money that the payer has paid as part of the payment, subtracting refunds.

Payment locale

The two-letter ISO 639 language and country code indicating the language that the Barion Smart Gateway was displayed to the user.

Possible values:

- "cs-CZ" (Czech)

- "de-DE" (German)

- "en-US" (English)

- "es-ES" (Spanish)

- "fr-FR" (French)

- "hu-HU" (Hungarian)

- "sk-SK" (Slovak)

- "sl-SI" (Slovenian)

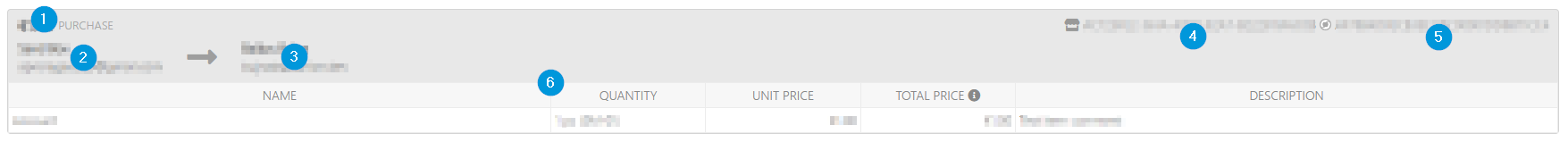

Payment structure

The list of the transactions that make up the payment, each displayed with the following information regions:

| Information region | Description |

|---|---|

| 1 | The transaction total. |

| 2 | The name and email address of the payer. The payer name is indicated only if the payer logged in to their Barion account. |

| 3 | The name and email address associated with the shop. |

| 4 | The identifier that the shop generated and assigned to the transaction. |

| 5 | The unique identifier generated and assigned to the transaction by Barion. |

| 6 | Itemized list of products or services purchased. |

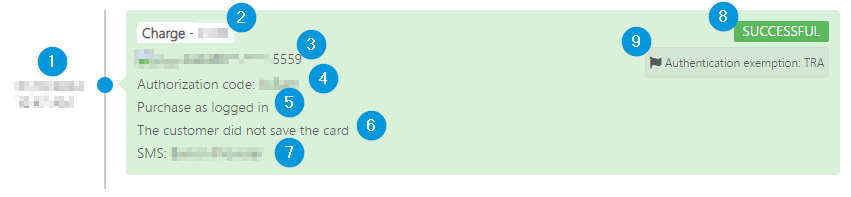

Payment attempts

| Information region | Description |

|---|---|

| 1 | The date and time of the payment attempt, in the shop's time zone and its locale's date and time format. |

| 2 | The amount that the payer attempted to pay. |

| 3 | The funding source for the transaction. |

| 4 | The authorization code assigned to the transaction by the card acquirer, if applicable. |

| 5 | Whether the payer was logged in to their Barion wallet. |

| 6 | Whether the payer paid using a saved card funding source. |

| 7 | The recipient of the transaction as displayed in notification messages and monthly statements. |

| 8 | The status of the transaction. |

| 9 | The authentication status of the payer. Possible values:

The payer wasn't authenticated because you requested a TRA exemption, and the transaction wasn't qualified as risky.

The payer abandoned the authentication process.

The payer entered incorrect authentication information.

The card issuer rejected the authentication request.

Strong Customer Authentication couldn't be performed.

The TRA exemption that you requested has been rejected because the transaction was qualified as risky. |

Callbacks

The date and time, HTTP response status code, and the target URL of all the callbacks triggered by the payment's status changes.

Note that callbacks are triggered not by a status change in the payment attempts associated with the payment, but by status changes of the payment as a whole. Read more about payment callbacks.

Callback logs are only retained for up to one year.

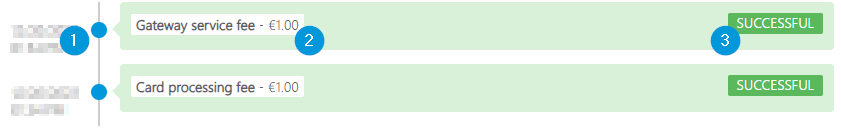

Fees

The list of payment process fees that Barion deducted from your balance for the payment.

Note that fees deducted by other participants involved in the payment process (such as banks or card companies) aren't listed.

| Information region | Description |

|---|---|

| 1 | The date and time when the fee was incurred, in your shop's time zone and its locale's date and time format. |

| 2 | The fee's type and amount. |

| 3 | The status of the fee: "Reserved" if the fee hasn't been deducted yet, or "Successful" if the fee is already deducted. |

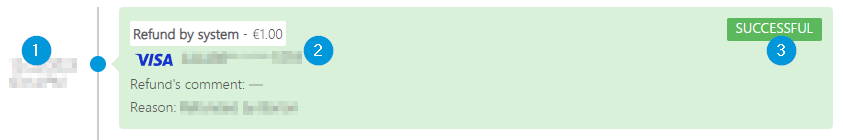

Refunds

| Information region | Description |

|---|---|

| 1 | The date and time of the refund, in your shop's time zone and its locale's date and time format. |

| 2 | Details of the refund: amount, receiving payment source, comments, and reason.

Possible reasons: "Refunded by Barion", "Refunded by System", and "Refunded due to Error". Note that reserved amounts that haven't been finalized during the reservation period will show up as refunds. |

| 3 | The status of the refund.

Possible values: "Prepared", "In progress", "Successful", and "Unsuccessful". |