Token payment upgrade to 3DS

Upgrading token payment implementation to comply with 3DS

Background

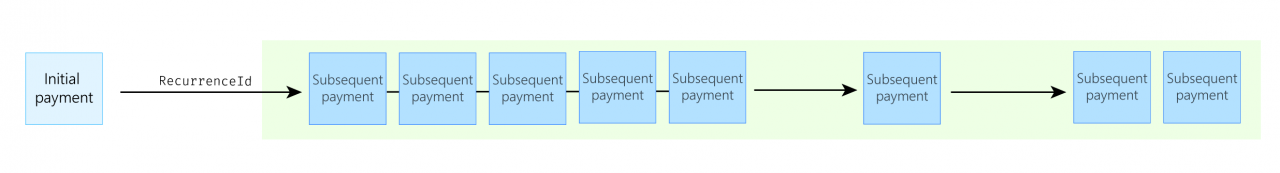

Token payment is a solution that enables the merchant to charge the payer without the presence of them. It is a powerful tool to conduct subscription-like or payer-not-present scenarios. This scenario requires the merchant to create a token that would act as an identifier for the payer's funding source. To attach that token to a valid funding source the merchant had to do several things:

- Create an alphanumeric token

- Conduct an initial payment in which this token gets registered in the Barion system

- Refer to this token in a subsequent payment attempt

This meant that as far as this token referenced a valid (and still available) funding source the merchant could create payments without any limitations. Basically, this token symbolized the funding source. It was up to the merchant to decide what it is used for, neither Barion nor the card issuer was aware of the nature of the subsequent payments.

This funding source can be either a card or an e-money wallet and this is up to the payer to choose. In case the payer chooses to fund the payment from their e-money wallet there is no further need for extra security. On the other hand, when it comes to card payment the authentication process changed with the new Strong Customer Authentication directive and the 3DS v2 protocol.

Changes

To make sure that the payer has more control over these token scenarios and the card issuer knows more about the payment scenarios several things need to be changed.

Token payment scenarios

First of all the merchant has to decide what kind of token payment scenario is suitable. These scenarios are the following:

- One-click payment: The payer clicks on the "Purchase" button but the charge happens in the background without the payer leaving the merchant's site.

- Recurring payment: The payer authorizes the merchant (at the initial payment) to charge their card periodically without being present with the same amount.

- Merchant initiated payment: The payer authorizes the merchant to charge their card without restrictions (eg. amounts can vary).

To decide on a suitable scenario, please read this detailed description

Usage of TraceId

3DS authentication requires another identifier. This new identifier is used to differentiate these token payment scenarios and help the issuer control what is a non-fraudulent transaction.

So from now on, there will be two IDs for every payer-not-present scenario:

RecurrenceIdfor the funding source: this identifies the source of the money (could be card or wallet)TraceId(new) for the nature of the charge: this identifies the type of token payment scenario the merchant is conducting.

This new TraceId is generated and stored by the card issuer. The Id is available in the /v4/Payment/<PaymentId>/PaymentState response once the charge is successfully completed.

Once the TraceId is acquired it must be sent in the Payment/Start request to identify the scenario. This is crucial for the card transactions otherwise they could be declined.

3DS v2 authentication

The new more secure 3DS v2 authentication must be conducted for every online card payment. These token payment scenarios also need to use these new secure way of authentication. The initial payment must be authenticated every time although the subsequent payments may be exempted in certain cases.

Technical changes required

The technical changes depend on what type of token scenario is needed for the business. It is important to notice that these scenarios can be implemented beside each other, a merchant is not required to choose only one type of token payment. The main goal is to appropriately use each scenario.

Technical changes for Recurring payments

- For the token registration in the Payment/Start request the new properties have to be specified:

"RecurrenceType" : "RecurringPayment"to indicate the scenarioPurchaseInformation.RecurringExpiryandPurchaseInformation.RecurringFrequencyfor the limitations

- Once the callback is received get the response of PaymentState. In case the charge was successful, there will be a

TraceIdproperty for the payment. The value of it must be saved and attached to the payment. - For subsequent payments in the Payment/Start request specify the

"RecurrenceType" : "RecurringPayment"- and the

TraceIdyou received for the initial payment.

Technical changes for Merchant initiated payments

- For the token registration in the Payment/Start request the new property has to be specified:

"RecurrenceType" : "MerchantInitiatedPayment"to indicate the scenario

- Once the callback is received get the response of PaymentState. In case the charge was successful, there will be a

TraceIdproperty for the payment. The value of it must be saved and attached to the payment. - For subsequent payments in the Payment/Start request specify the

"RecurrenceType" : "MerchantInitiatedPayment"- and the

TraceIdyou received for the initial payment.

Technical changes for One-click payments

This modification needs the most attention since the merchant has to implement client-side functionality and add a new step at the end of the flow.

- For the token registration in the Payment/Start request the new property has to be specified:

"RecurrenceType" : "OneClickPayment"to indicate the scenario

- For subsequent payments the merchant has to integrate the barion.offsitegw.js to be able to authenticate the payer via 3DS v2 on the merchant's site. To do this read the tutorial on how to integrate this.

- After a successful authentication a new Barion API endpoint (/Payment/Complete) must be called to finalize the process and charge the card

Please notice that in case this scenario is used there is no need to use the TraceId since the 3DS authentication will be performed every time.