Token payment upgrade to 3DS: Difference between revisions

No edit summary |

No edit summary |

||

| Line 55: | Line 55: | ||

{{NotificationBox|title=CHANGE|text=The intended scenario must be specified in the new [[RecurrenceType|ReccurenceType]] property (located in the [[Payment-Start-v2|Payment/Start]] request)|color=#20c400}} | {{NotificationBox|title=CHANGE|text=The intended scenario must be specified in the new [[RecurrenceType|ReccurenceType]] property (located in the [[Payment-Start-v2|Payment/Start]] request)|color=#20c400}} | ||

== Usage of TraceId == | |||

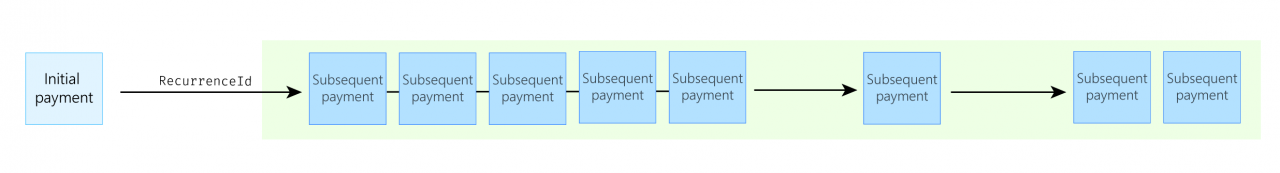

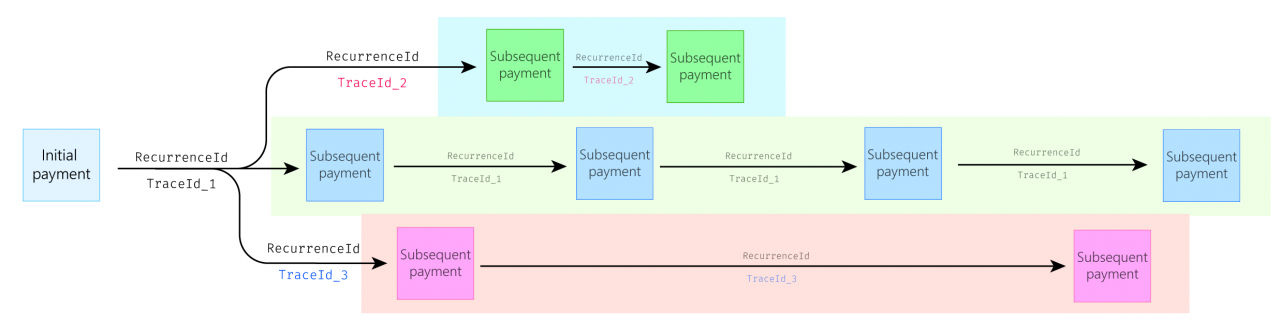

3DS authentication requires another identifier. This new identifier is used to differentiate these token payment scenarios. | |||

From now on there will be two IDs for every payer-not-present scenario: | |||

* <code>RecurrenceId</code> for the funding source: this identifies the source of the money (could be card or wallet) | |||

* <code>TraceId</code> (new) for the ''nature of the charge:'' this identifies the type of token payment scenario the merchant is conducting. | |||

This new <code>TraceId</code> is generated by the card issuer and stored by Barion. The Id is available in the [[Payment-GetPaymentState-v2|GetPaymentState]] response once the charge is successfully completed. | |||

[[File:Recurring-post3ds.png|1280px]] | |||

{{NotificationBox|title=CHANGE|text=The TraceId must processed from the [[Payment-GetPaymentState-v2|GetPaymentState]] response and should be sent during the subsequent charges. |color=#20c400}} | |||

| Line 76: | Line 93: | ||

Revision as of 22:01, 18 November 2020

Upgrading token payment implementation to comply with 3DS

Background

Token payment is a solution that enables the merchant to charge the payer without the presence of them. It is a powerful tool to conduct subscription-like or payer-not-present scenarios. This scenario requires the merchant to create a token that would act as an identifier for the payer's funding source (may it be a credit card or a Barion e-money account). To attach that token to a valid funding source the merchant had to do several things:

- Create an alphanumeric token

- Conduct an initial payment in which this token gets registered in the Barion system

- Refer to this token in a subsequent payment attempt

This meant that as far as this token referenced a valid (and still available) funding source the merchant could create payments without any limitations. Basically, this token symbolized the funding source. It was up to the merchant to decide what it is used for, neither Barion nor the card issuer was aware of the nature of the subsequent payments.

Changes

To make sure that the payer has more control over these scenarios and the card issuer knows more about the payment scenarios several things need to be provided.

Token payment scenarios

First of all the merchant has to decide what kind of token payment scenario is suitable. These scenarios are the following:

- One-click payment: The payer clicks on the "Purchase" button but the charge happens in the background without the payer leaving the merchant's site.

- Recurring payment: The payer authorizes the merchant (at the initial payment) to charge their card periodically without being present.

- Merchant initiated payment: The payer authorizes the merchant to charge their card without restrictions.

These scenarios have different properties and requirements, this table below summarizes the key differences.

| Scenario | Payer present? | Amount | Frequency | Liability |

|---|---|---|---|---|

| One-click payment | Yes | Various | Various | Card issuer |

| Recurring payment | No | Various | Fixed | Card issuer |

| Merchant initiated payment | No | Various | Various | Merchant |

Explanation:

Payer present: indicates whether the payer is present during the subsequent payments. During the first (initial) payment, the payer is always present in every scenario.

Amount: specifies whether the amount of the payments can change from payment to payment or must be the same.

Frequency: specifies whether it is mandatory to wait a fixed number of days between payments or the charges can happen ad-hoc.

Liability: describes the entity who is liable for the payment in case of fraud

To help you decide on a suitable scenario, please use the decision chart graph below:

File:3ds-recurrencetype-decision.jpg

Usage of TraceId

3DS authentication requires another identifier. This new identifier is used to differentiate these token payment scenarios.

From now on there will be two IDs for every payer-not-present scenario:

RecurrenceIdfor the funding source: this identifies the source of the money (could be card or wallet)TraceId(new) for the nature of the charge: this identifies the type of token payment scenario the merchant is conducting.

This new TraceId is generated by the card issuer and stored by Barion. The Id is available in the GetPaymentState response once the charge is successfully completed.

Prepare for 3DS authentication

The new more secure 3DS v2 authentication must be conducted for every online card payment. These token payment scenarios also need to use these new secure way of authentication. The initial payment must be authenticated every time although the subsequent payments may be exempted in certain cases. This table displays the different scenarios and the 3DS authentication requirements.

| Scenario | Initial payment | Subsequent payments |

|---|---|---|

| One-click payment | ✔️ | ✔️ |

| Recurring payment | ✔️ | |

| Merchant initiated payment | ✔️ |

What happens if I don't change my implementation

TODO